It was around midnight, January 31, when K. received an email from Coinbase containing a 1099 tax form. That was strange enough – K. certainly didn’t expect a cryptocurrency exchange to be a conduit for government documents.

Then K. looked at how much Coinbase said he owed money on: $2.4 million.

“I initially freaked out, considering I’ve probably put in a max of $8,000 into Coinbase and somehow I may be liable for millions?” K. said in an online chat with CoinDesk.

The next business day, K. called Coinbase customer support, only to have a representative tell him he couldn’t answer the details on the phone, and to email the company instead.

Which he did, only to get a formulaic response showing the IRS guidance to Coinbase.

To this day, K says he has no idea where the $2.4 million figure came from. He says he is too busy to jump through more hoops with the largest exchange in the U.S., and that he feels safe in the knowledge that he doesn’t have to pay taxes on $2.4 million in earnings, since they don’t exist.

More users, more problems

K. is far from alone in wrestling with an apparent misfire from Coinbase.

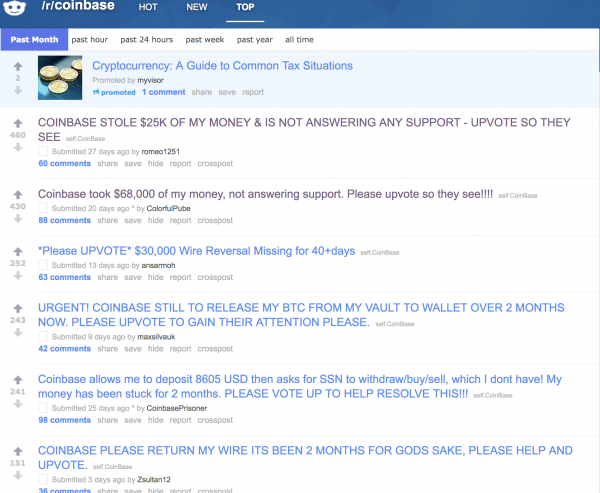

In recent weeks, complaints have been piling up on a Reddit page dedicated to the company. The issues mentioned are wide-ranging: missing wires, unreleased bitcoin, disabled accounts.

The top posts on the page over the past month look like this:

A representative for Coinbase, Stephanie Kendall, said the company was unable to comment on the complaints.

Stepping back, as crypto values spiked during the recent run-up, several major exchanges heaved under the weight of new demand. Kraken, the third-largest exchange in the world, suffered an outage earlier this year that was supposed to take two hours but ended up lasting two days as it upgraded its system.

Bitfinex also suffered a malfunction late last year due to a denial-of-service attack.

But perhaps above all others, user growth at Coinbase has gone gangbusters. The userbase has more than doubled since 2016 to more than 10 million customers today, according to spokeswoman Kendall. The company now employs about 200 people, she said.

Service at the exchange had already begun showing signs of strain when the company announced in August it had raised $100 million, and said some of the new funding would go toward alleviating customer service pressure. Late last month, it hired a new vice president of operations and technology, Tina Bhatnager, to oversee customer support. It also appointed Dan Romero with the title of general manager of Coinbase, in a blog with the headline: “Customer support: failure is not an option.”

But the complaints are still coming in fast and furious.

Perhaps most distressingly, a number of Coinbase users recently reported unauthorized charges to their linked bank accounts. In some cases, these charges, which duplicated previous legitimate withdrawals, completely drained customers’ funds and left them owing their banks hefty overdraft fees.

And now, perhaps sensing a weakness, formidable new competitors are encroaching on Coinbase’s retail turf: the stock brokerage platform Robinhood, which now has 1 million crypto users; and Square, which now allows buying and selling bitcoin through the Square Cash app.

Squeaky wheels

For now, though, there remains the question of what to do if you’re impacted.

Coinbase user Suzepo, who lives in Italy, says it took him three tries over the course of a month for his verification deposits to go through. It was apparently only after he added the name of his bank that it went through; there were apparently no instructions on Coinbase’s part that this was necessary.

He said that in his attempts to reach Coinbase, he didn’t get a single response until the very end of his ordeal. While he appreciates that there was no delayed purchases, and immediate fund input, he ultimately felt frustrated by the support assistance, or lack thereof.

“No response from the support team, customers left alone to deal with their own issues and that big [verification] transfer burden,” he says.

Reddit user crypt_iss complained about a botched transaction in a post that was heavily upvoted on Coinbase’s subreddit. As of last week, he said he has “technically withdrawn” the amount but it is still not in his Coinbase vault. Yet Coinbase shows the transaction as completed in one location and pending in another, he says.

“No one from help desk has called, it is only email messages. If this post would not had risen to top here, even this would not had happened. I really cannot believe they have such poor handling of so many parts. Move fast and break things culture I guess,” he said.

Sergej Kotliar, the CEO of crypto mobile phone card provider Bitrefill, told CoinDesk he had no reason to believe the users’ complaints weren’t legitimate.

Making a stink on social media “is a good way to get helped, and people who are missing tens of thousands of dollars can get pretty upset,” he said.

Kotliar also said he doubted the complaints were being astroturfed, i.e. orchestrated by competitors to sow doubts about Coinbase.

“Who would be their rivals? This is growing pains,” he said. “They really grew very big.”

Disclaimer: CoinDesk is a subsidiary of Digital Currency Group, which has an ownership stake in Coinbase.

Coinbase image via Shutterstock

The leader in blockchain news, CoinDesk is an independent media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. Interested in offering your expertise or insights to our reporting? Contact us at news@coindesk.com.

Disclaimer: This article should not be taken as, and is not intended to provide, investment advice. Please conduct your own thorough research before investing in any cryptocurrency.

https://www.coindesk.com/bitcoin-soars-coinbase-customer-complaints/